f6john

Member

Posts: 9722

Christ first and always

Richmond, Kentucky

|

|

« on: September 20, 2018, 01:17:05 PM » |

|

Stock Market hit another all time high today. People are so happy he’s gone they won’t even care when he takes credit once again for our economy.

I hope everyone who predicted a crash with the election of Trump was able to pull their money out and still have it under the mattress.

|

|

|

|

|

Logged

Logged

|

|

|

|

|

..

|

|

« Reply #1 on: September 20, 2018, 01:19:20 PM » |

|

If T is doing such a bad job why does O try to take the credit and praise?

|

|

|

|

|

Logged

Logged

|

|

|

|

|

Davemn

|

|

« Reply #2 on: September 20, 2018, 01:49:34 PM » |

|

And now a word from an expert(s).........(for the record I didn’t vote for either of the 2 morons in 2015)

Ken Rogoff, Harvard economics and public policy professor, discussed the stock market rally and several reasons for recent stock market growth on CNN recently. Interest rates are low, and have been for quite some time, despite several increases this year. When interest rates are low, companies borrow more, grow and expand, leading to greater profitability and rising stock prices. When fixed investment returns are low, investors — seeking decent returns — have nowhere to go but the stock market.

Improving global growth is another cause for the current rising stock market. As international economies improve, so do global companies’ stock prices. The World Bank forecasted global economic growth above 3 percent in 2018, following a stronger than expected 2017. Global businesses are improving manufacturing and trade as commodity prices are stabilizing. And that boosts stock prices.

Rogoff describes the economy as a big ship, difficult to turn around. When Trump came into office 18 months ago, the economy was growing, and the stock market was in the midst of an eight-year bull run. The president came into office with a nice tail wind behind the economy and markets.

Barbara A. Friedberg, MBA, MS is a veteran portfolio manager, expert investor, and former university finance instructor. She is editor/author of “Personal Finance; An Encyclopedia of Modern Money Management” and two additional money books. She is CEO of Robo-Advisor Pros.com, a robo-advisor review and information website. Additionally, Friedberg is publisher of the well-regarded investment website Barbara Friedberg Personal Finance.com.

|

|

|

|

|

Logged

Logged

|

|

|

|

|

Serk

|

|

« Reply #3 on: September 20, 2018, 02:02:09 PM » |

|

"It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover? Frankly, I find it hard to care much, even though this is my specialty. The disaster for America and the world has so many aspects that the economic ramifications are way down my list of things to fear. Still, I guess people want an answer: If the question is when markets will recover, a first-pass answer is never." "So we are very probably looking at a global recession, with no end in sight." Source - https://www.nytimes.com/interactive/projects/cp/opinion/election-night-2016/paul-krugman-the-economic-falloutSo sayeth Nobel Prize Winning Economist Paul Krugman. (Guess the Nobel Prize in Economics means almost as much as the Nobel Peace Prize does after they awarded it to Obama (pbuh) for being half black.)  "Trump's domestic policies would lead to recession." said the Democrat pretending to be a Republican Mitt Romney. "If Trump wins we should expect a big markdown in expected future earnings for a wide range of stocks — and a likely crash in the broader market (if Trump becomes president)." Eric Zitzewitz, former chief economist at the IMF, November 2016. "Trump would likely cause the stock market to crash and plunge the world into recession." Simon Johnson, MIT economics professor, in The New York Times, November 2016 It would seem all the "smart money" says right now we should be in the midst of an Obama level recession/depression..... And yet, here we are. |

|

|

|

|

Logged

Logged

|

Never ask a geek 'Why?',just nod your head and slowly back away...  IBA# 22107 VRCC# 7976 VRCCDS# 226 1998 Valkyrie Standard 2008 Gold Wing Taxation is theft. μολὼν λαβέ |

|

|

f6john

Member

Posts: 9722

Christ first and always

Richmond, Kentucky

|

|

« Reply #4 on: September 20, 2018, 02:17:28 PM » |

|

If we could get all the Obama loving democrats to donate all their stock market gains since Trump took office we could knock a lot of the national debt back to at least pre 9-11.

|

|

|

|

|

Logged

Logged

|

|

|

|

|

Savago

|

|

« Reply #5 on: September 20, 2018, 02:28:53 PM » |

|

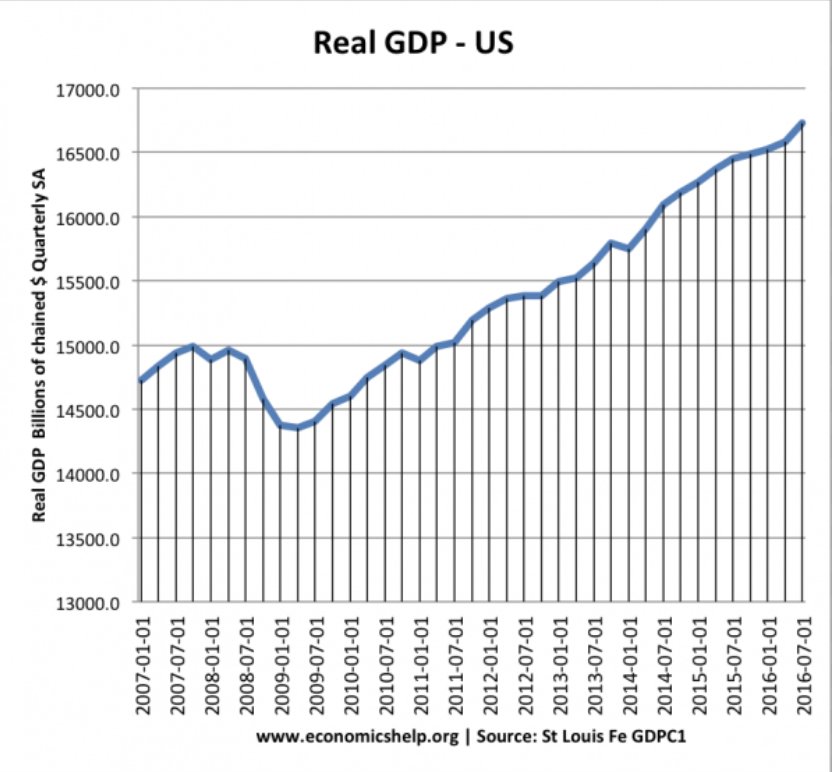

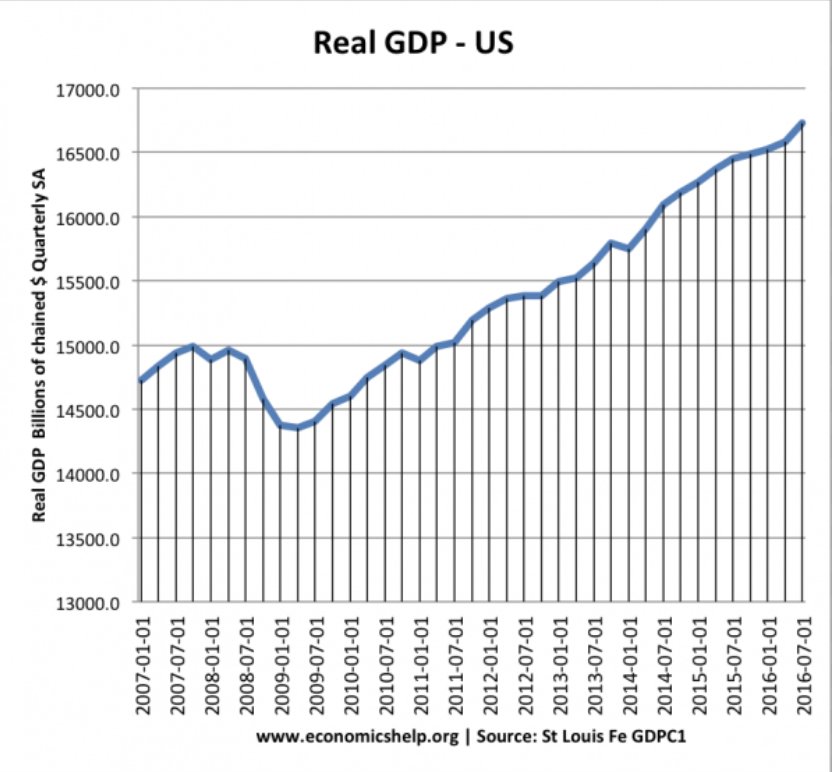

My reply, in one chart:  |

|

|

|

|

Logged

Logged

|

|

|

|

Willow

Administrator

Member

Posts: 16758

Excessive comfort breeds weakness. PttP

Olathe, KS

|

|

« Reply #6 on: September 20, 2018, 02:35:22 PM » |

|

"It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover?

...

It would seem all the "smart money" says right now we should be in the midst of an Obama level recession/depression.....

And yet, here we are. Wow! Just think of what a boom it would be if we weren't in the President Trump recession!  |

|

|

|

|

Logged

Logged

|

|

|

|

|

|

|

..

|

|

« Reply #8 on: September 20, 2018, 03:57:15 PM » |

|

|

|

|

|

|

Logged

Logged

|

|

|

|

Willow

Administrator

Member

Posts: 16758

Excessive comfort breeds weakness. PttP

Olathe, KS

|

|

« Reply #9 on: September 20, 2018, 04:01:09 PM » |

|

Barack says, "you are welcome".  We do have to work on developing that sarcasm font.  |

|

|

|

|

Logged

Logged

|

|

|

|

|

|

f6john

Member

Posts: 9722

Christ first and always

Richmond, Kentucky

|

|

« Reply #11 on: September 20, 2018, 04:48:53 PM » |

|

My reply, in one chart:  Thank you for that, I’ll sleep better tonight with that info in hand. |

|

|

|

|

Logged

Logged

|

|

|

|

|

¿spoom

|

|

« Reply #12 on: September 20, 2018, 04:56:05 PM » |

|

FWIW, with Barack gone, that will keep rising. Under Obama, the Chairman of the Fed was Janet Yellen who kept lower interest rates to near nothing and and printing money like party favors to artificially prop up an economy and support a President no matter what the overall effects - including retired folks living off of SS augmented by CDs that went down close to 0% . Now that Obama and Yellen are gone, the Prime is going back up again. In response, I notice 30 year fixed mortgages have crept to 5%, and even 6 mo. CD's can be found at 2% in larger amounts. |

|

|

|

|

Logged

Logged

|

|

|

|

|

F6Dave

|

|

« Reply #13 on: September 20, 2018, 05:43:48 PM » |

|

Where are the Trump years in that chart?

The previous 8 years might look impressive, until you check out the actual numbers on the Y axis. Looks roughly like about 2% per year.

|

|

|

|

|

Logged

Logged

|

|

|

|

|

Serk

|

|

« Reply #14 on: September 20, 2018, 05:54:40 PM » |

|

Where are the Trump years in that chart?

The previous 8 years might look impressive, until you check out the actual numbers on the Y axis. Looks roughly like about 2% per year.

"Real gross domestic product (GDP) increased 4.2 percent in the second quarter of 2018" Source - https://www.bea.gov/news/glance |

|

|

|

|

Logged

Logged

|

Never ask a geek 'Why?',just nod your head and slowly back away...  IBA# 22107 VRCC# 7976 VRCCDS# 226 1998 Valkyrie Standard 2008 Gold Wing Taxation is theft. μολὼν λαβέ |

|

|

|

..

|

|

« Reply #15 on: September 21, 2018, 01:02:11 AM » |

|

How much did O's Fed pump into the economy?

A country's gross domestic product can be calculated using the following formula: GDP = C + G + I + NX. C is equal to all private consumption, or consumer spending, in a nation's economy, G is the sum of government spending, I is the sum of all the country's investment, including businesses capital expenditures and NX is the nation's total net exports, calculated as total exports minus total imports (NX = Exports - Imports).

|

|

|

|

|

Logged

Logged

|

|

|

|

|

Robert

|

|

« Reply #16 on: September 21, 2018, 03:46:41 AM » |

|

One graph does not really tell the story of the Obama years. Here is some more information on what GDP and debt really look like under Obama. Also under Obama the national debt doubled partly due to the housing market. The amount the health care tax has not been put in this figure either. The debt-to-GDP ratio is the ratio of a country's public debt to its GDP. By comparing what a country owes with what it produces, the debt-to-GDP ratio indicates its ability to pay back its debts. Often expressed as a percentage, this ratio can also be interpreted as the number of years needed to pay back debt if GDP is dedicated entirely to debt repayment. The United States had a debt-to-GDP ratio of 104.17 percent in 2015 and 105.4 percent in 2017, according to the U.S. Bureau of Public Debt. The U.S. experienced its highest debt-to-GDP ratio in 1946 at 121.7 percent at the end of World War II, and its lowest in 1974 at 31.7 percent. Debt levels gradually fell from their post-World War II peak before plateauing between 31 percent and 40 percent in the 1970s. They have been rising steadily since 1980, jumping sharply following the subprime housing crisis of 2007 and subsequent financial meltdown.  Obama's presidency can be summed up like Obama care, he was not the designer just the one that got the credit or flack depending on what side your on. The one that allowed an agenda not the orchestrator. |

|

|

|

« Last Edit: September 21, 2018, 04:54:56 AM by Robert »

|

Logged

Logged

|

“Some people see things that are and ask, Why? Some people dream of things that never were and ask, Why not? Some people have to go to work and don’t have time for all that.”

|

|

|

|

¿spoom

|

|

« Reply #17 on: September 21, 2018, 06:35:27 AM » |

|

One graph does not really tell the story of the Obama years. Here is some more information on what GDP and debt really look like under Obama. Also under Obama the national debt doubled partly due to the housing market. The amount the health care tax has not been put in this figure either. The debt-to-GDP ratio is the ratio of a country's public debt to its GDP. By comparing what a country owes with what it produces, the debt-to-GDP ratio indicates its ability to pay back its debts. Often expressed as a percentage, this ratio can also be interpreted as the number of years needed to pay back debt if GDP is dedicated entirely to debt repayment. The United States had a debt-to-GDP ratio of 104.17 percent in 2015 and 105.4 percent in 2017, according to the U.S. Bureau of Public Debt. The U.S. experienced its highest debt-to-GDP ratio in 1946 at 121.7 percent at the end of World War II, and its lowest in 1974 at 31.7 percent. Debt levels gradually fell from their post-World War II peak before plateauing between 31 percent and 40 percent in the 1970s. They have been rising steadily since 1980, jumping sharply following the subprime housing crisis of 2007 and subsequent financial meltdown.  Obama's presidency can be summed up like Obama care, he was not the designer just the one that got the credit or flack depending on what side your on. The one that allowed an agenda not the orchestrator. But he IS the one who signed it into law. It didn't happen despite him. |

|

|

|

|

Logged

Logged

|

|

|

|

|