|

Savago

|

|

« on: December 04, 2017, 03:55:51 PM » |

|

I've heard a lot about it and read a few articles and would like to hear you guys opinions on the subject.

It seems that it is crafting to be a Gov handover to big companies and a bad deal if you are middle class.

One example is deducting the interest of buying a home: Gone!

State tax deduction (a big deal in California)? Gone!

And quite a few others...

From what I read, it will also create a serious government deficit, which they are planning to make up to in 4 years when taxes will go up for middle class/workers and young people (X generation and Millennials).

From what I understood, there are just the following people who will benefit:

a) Big Corporations & Millionaries: the tax break is forever.

b) Low income: less than 70K/year.

c) Retired people.

|

|

|

|

« Last Edit: December 04, 2017, 04:14:00 PM by Savago »

|

Logged

Logged

|

|

|

|

Rams

Member

Posts: 16703

So many colors to choose from yet so few stand out

Covington, TN

|

|

« Reply #1 on: December 04, 2017, 04:14:04 PM » |

|

The proposed bill still has to be rectified with the house version therefore we don’t know what it’s going to end up being. I will reserve judgment Until I know precisely what it is. Until then it’s all propaganda from both sides

|

|

|

|

|

Logged

Logged

|

VRCC# 29981

Learning the majority of life's lessons the hard way.

Every trip is an adventure, enjoy it while it lasts.

|

|

|

|

The emperor has no clothes

|

|

« Reply #2 on: December 04, 2017, 04:18:08 PM » |

|

The proposed bill still has to be rectified with the house version therefore we don’t know what it’s going to end up being. I will reserve judgment Until I know precisely what it is. Until then it’s all propaganda from both sides

Not at all. The differences between the House version and Senate version are minimal. But at least Trump won't benefit from the proposals.   |

|

|

|

|

Logged

Logged

|

|

|

|

|

scooperhsd

|

|

« Reply #3 on: December 04, 2017, 04:19:27 PM » |

|

Did anybody actually consider WHO is paying for these "Tax breaks" ? The middle class of course.

We should have learned from Reagan - "Trickle Down Economics" do not work for anybody but the rich - who don't send them out to the rest of us....

|

|

|

|

|

Logged

Logged

|

|

|

|

|

Jess from VA

|

|

« Reply #4 on: December 04, 2017, 04:59:12 PM » |

|

Cutting taxes is good.

It's especially good if it is immediately followed by a giant cut in G spending, closing entire G departments, furloughing tens of thousands of bureaucrats, and shrinking it down to say half it's size. The only way to cut government, is to cut off their money (our money).

The way to cut the deficit is not to increase taxes (which will never be used on the deficit, it will just be pissed away anyway), it's to cut the government.

They do very little right or well anyway.

|

|

|

|

|

Logged

Logged

|

|

|

|

bill-jr

Member

Posts: 1047

VRCC # 35094

murfreesboro

|

|

« Reply #5 on: December 04, 2017, 05:12:27 PM » |

|

70 k / is only low income if you live in certain places

Ie. Ca NY IL

I hear it will prob not be very accepted in these areas

In middle america i think 70k is a bit more than it is to others

Im in for change and i was willing and still am willing to give trump his eight years

I am still very hopeful for tax reform amd many other issues that TRUMP has ran on

And i hope we still build the wall . . . . .

|

|

|

|

|

Logged

Logged

|

Ever danced with the devil In the pale moon light ?

99' Black tourer

|

|

|

|

The emperor has no clothes

|

|

« Reply #6 on: December 04, 2017, 05:14:37 PM » |

|

The way to cut the deficit is not to increase taxes (which will never be used on the deficit, it will just be pissed away anyway), it's to cut the government.

Incorrect. Reagan cut taxes. The deficit increased. Clinton raised taxes. The deficit shrank (to the point of a surplus). George W. Bush cut taxes. The deficit increased.  |

|

|

|

|

Logged

Logged

|

|

|

|

|

Serk

|

|

« Reply #7 on: December 04, 2017, 05:25:52 PM » |

|

|

|

|

|

|

Logged

Logged

|

Never ask a geek 'Why?',just nod your head and slowly back away...  IBA# 22107 VRCC# 7976 VRCCDS# 226 1998 Valkyrie Standard 2008 Gold Wing Taxation is theft. μολὼν λαβέ |

|

|

Oss

Member

Posts: 12764

The lower Hudson Valley

Ossining NY Chapter Rep VRCCDS0141

|

|

« Reply #8 on: December 04, 2017, 05:28:39 PM » |

|

It doesnt matter, if it comes from washington we are screwed big time.

I dont like what I have seen so far

Like Jess says, cut the freakin government first, then play with the tax code

|

|

|

|

|

Logged

Logged

|

If you don't know where your going any road will take you there

George Harrison

When you come to the fork in the road, take it

Yogi Berra (Don't send it to me C.O.D.)

|

|

|

|

Raider

|

|

« Reply #9 on: December 04, 2017, 05:31:52 PM » |

|

One example is deducting the interest of buying a home: Gone!

State tax deduction (a big deal in California)? Gone!

Interest deduction is not gone in the final bill. Interest paid on the first $500,000 of mortgage is still deductible. Most Americans don't own a home over that amount (naturally, excluding CA, NYC, etc.). Average and median home prices for new construction ranged in $3-400,000 range for all of 2017 (record highs). Median home price is about $189,000. https://www.census.gov/construction/nrs/pdf/uspricemon.pdfhttps://www.huffingtonpost.com/2014/03/13/median-home-price-2014_n_4957604.htmlAll but the pretty dang wealthy keep their benefit. FURTHER, interest paid in the first years of a 30 year, $300,000 mortgage is about $13,000. It drops steadily each year. The total standard deduction will INCREASE to $24,000. The standard deduction will be better for the middle class than itemizing will. As for the state deduction, why should the rest of the nation have to pick up slack for California's (or pick your other heavily socialized state) insane taxes? Bottom line is that you're falling for the MSM propaganda. |

|

|

|

|

Logged

Logged

|

|

|

|

|

Savago

|

|

« Reply #10 on: December 04, 2017, 06:03:33 PM » |

|

@Raider: I liked your analysis and it is good to know that the standard deduction may increase.

Just 2 data points that can be helpful:

a) The median cost for a house in Santa Clara County (here in SF Bay Area) is around 800K dollars. Keep in mind that is for an old 2 bedrooms house (Yeah totally insane! That makes me wonder if I should move to other State).

b) Even with the State deduction, for each 1 dollar that California population pays to the Federal government, only 0.70 comes back. IIRC, California and Texas are the biggest economies and the bigger contributors to USA government balance. So it is not like the other States are paying for our deductions.

|

|

|

|

« Last Edit: December 04, 2017, 06:36:19 PM by Savago »

|

Logged

Logged

|

|

|

|

|

Raider

|

|

« Reply #11 on: December 04, 2017, 06:40:21 PM » |

|

Savago, Yup, fully understand the real estate prices in CA. In fact, you guys skew the averages! Even still, the household deduction is almost all of your interest paid in year 1 of the $800K mortgage. According to politifact, for every dollar CA pays, they receive .99 back. http://www.politifact.com/california/article/2017/feb/14/does-california-give-more-it-gets-dc/Even still, we pay taxes to pay for governmental services (protecting borders, enabling commerce, enforcing rule of law), not to receive aid back. |

|

|

|

|

Logged

Logged

|

|

|

|

Oss

Member

Posts: 12764

The lower Hudson Valley

Ossining NY Chapter Rep VRCCDS0141

|

|

« Reply #12 on: December 04, 2017, 08:02:20 PM » |

|

I would rather see the deduction for state taxes paid as otherwise its just taking from peter to pay paul

Where will the money come from when people start leaving states with income tax ? That is just dumb and dumber

The 500k business on mtg interest makes sense but why not make it slide up to 700 if the median home price in the area goes that high?

|

|

|

|

|

Logged

Logged

|

If you don't know where your going any road will take you there

George Harrison

When you come to the fork in the road, take it

Yogi Berra (Don't send it to me C.O.D.)

|

|

|

|

Robert

|

|

« Reply #13 on: December 05, 2017, 03:36:46 AM » |

|

Savago thanks for bringing in some information on this, but I have found your sources a bit skewed to the left. So I will wait to what shakes down, for some reason after going through the health care debacle with Obama I am a bit less worried what Trump will do with taxes. He has been pretty good at keeping a steady pace of keeping his promises and knows what will help people, so I hate to say it, but may have a bit of trust in him to do the right thing.

It never dawned on me the impact of what the previous admin was doing to make small business, the back bone of America, all but non existent. He has made it much harder to start, run, and keep a small business going and hopefully Trump will continue to change this trend.

The fact that we have not heard to much hoopla on the tax bill and it has passed pretty easily makes me a bit worried though.

|

|

|

|

« Last Edit: December 05, 2017, 03:39:15 AM by Robert »

|

Logged

Logged

|

“Some people see things that are and ask, Why? Some people dream of things that never were and ask, Why not? Some people have to go to work and don’t have time for all that.”

|

|

|

Skinhead

Member

Posts: 8742

J. A. B. O. A.

Troy, MI

|

|

« Reply #14 on: December 05, 2017, 04:33:57 AM » |

|

Just 2 data points that can be helpful:

a) The median cost for a house in Santa Clara County (here in SF Bay Area) is around 800K dollars. Keep in mind that is for an old 2 bedrooms house (Yeah totally insane! That makes me wonder if I should move to other State).

California is a beautiful state, Your state government and liberal, elitist population are what ruins the state for "normal" folks. I don't wonder a bit. In fact, the people in states that Californians are fleeing to have been complaining for years that the Cali refugees are ruining their states. Shrink the government, get them out of our lives! |

|

|

|

|

Logged

Logged

|

Troy, MI |

|

|

|

Serk

|

|

« Reply #15 on: December 05, 2017, 05:50:15 AM » |

|

Let's hear what a famous hard right conservative had to say about tax cuts, shall we? https://www.youtube.com/watch?v=aEdXrfIMdiU |

|

|

|

|

Logged

Logged

|

Never ask a geek 'Why?',just nod your head and slowly back away...  IBA# 22107 VRCC# 7976 VRCCDS# 226 1998 Valkyrie Standard 2008 Gold Wing Taxation is theft. μολὼν λαβέ |

|

|

Gavin_Sons

Member

Posts: 7109

VRCC# 32796

columbus indiana

|

|

« Reply #16 on: December 05, 2017, 07:20:50 AM » |

|

Why do all liberals hate this? If this passes it will put 15k more a year in my pocket. Everything I haved read claims to not help the rich so much but middle class and small businesses. I think all of you liberals only listen to your side. Liberals are just pissed because it was not their idea and assault rifle is not attached to it somehow.

|

|

|

|

|

Logged

Logged

|

|

|

|

|

dinosnake

|

|

« Reply #17 on: December 05, 2017, 09:27:08 AM » |

|

Why do all liberals hate this? If this passes it will put 15k more a year in my pocket. Everything I haved read claims to not help the rich so much but middle class and small businesses. I think all of you liberals only listen to your side. Liberals are just pissed because it was not their idea and assault rifle is not attached to it somehow.

Mostly because, after listening to conservatives whine for decades about doing anything that raises the national debt... they vote for a tax plan that, not only grants the most benefits to corporations and those who can already afford to be in the [high] tax brackets where most of the reductions occur... it raises the national debt by 1.5 TRILLION DOLLARS. In other words, MORE HYPOCRISY. When it's a 'liberal' making a social package that happens to increase the debt, it's world-ending. When it's a conservative making a social package that happens to increase the debt...why are we complaining, exactly??? Not at all. The differences between the House version and Senate version are minimal. But at least Trump won't benefit from the proposals.    I hope that  was [/sarcasm], it's hard to tell. Because Trump will HIGHLY benefit from the tax cuts, his businesses are set up as "pass-through" (limited liability) corporations...which, conveniently, get some of the largest cuts in terms of operations. https://www.nytimes.com/2017/11/30/business/trump-benefit-tax-cuts.htmlhttps://www.washingtonpost.com/news/wonk/wp/2016/08/10/donald-trumps-new-tax-plan-could-have-a-big-winner-donald-trumps-companies/Did anybody actually consider WHO is paying for these "Tax breaks" ? The middle class of course.

We should have learned from Reagan - "Trickle Down Economics" do not work for anybody but the rich - who don't send them out to the rest of us....

That's the joke. 33% of the American public is constantly being gaslighted http://www.bbc.co.uk/news/stories-41915425Read it - it is NOT about politics, Trump, or anyone in government at all. It is about relationships. But does all that sound familiar? Charm your socks off...promises never kept. Things not working? It's your fault for not doubling-down and making it work out for me. Asking you for sacrifice...but always seems to end up one-sided. Yep. |

|

|

|

« Last Edit: December 05, 2017, 09:35:56 AM by dinosnake »

|

Logged

Logged

|

|

|

|

|

Serk

|

|

« Reply #18 on: December 05, 2017, 09:32:56 AM » |

|

When it's a 'liberal' making a social package that happens to increase the debt, it's world-ending. When it's a conservative making a social package that happens to increase the debt...why are we complaining, exactly???

Because there is a world of difference between giving away stolen goods to people to buy their votes and stealing less from people who are actually earning their way. |

|

|

|

|

Logged

Logged

|

Never ask a geek 'Why?',just nod your head and slowly back away...  IBA# 22107 VRCC# 7976 VRCCDS# 226 1998 Valkyrie Standard 2008 Gold Wing Taxation is theft. μολὼν λαβέ |

|

|

|

dinosnake

|

|

« Reply #19 on: December 05, 2017, 09:41:32 AM » |

|

When it's a 'liberal' making a social package that happens to increase the debt, it's world-ending. When it's a conservative making a social package that happens to increase the debt...why are we complaining, exactly???

Because there is a world of difference between giving away stolen goods to people to buy their votes and stealing less from people who are actually earning their way. And that's why they have you brainwashed. If we are talking about "giving away" - GIVING AWAY is GIVING AWAY. There is NO difference on who it goes to. You're still GIVING IT! So to believe that these "special" people - the ones who earned, so they deserve to keep more of it than the rest of us - is exactly what the Founding Fathers fought against. You're creating a plutocracy. The people who can get more...should be given more. More benefits. Breaks, that rest of us don't get. Because they are "deserving". How? Because they are... there. They did something - anything - to have more, so give them a break so that they get to keep even more. While the rest of us constantly struggle. EVERY poll, expert, and survey, says that middle class income has stagnated. For THIRTY years. But let's just keep going on with what we keep doing. Has to work sometime, right??   But don't let facts get in the way of beliefs, who am I to pass judgment? |

|

|

|

|

Logged

Logged

|

|

|

|

|

Serk

|

|

« Reply #20 on: December 05, 2017, 10:12:08 AM » |

|

To say you have a claim to my property is to say you have a claim to the labor I performed to obtain it.

To say you have a claim to my labor is to say that I am your slave.

Taxation is not only theft, it is slavery.

I will fight in favor of reducing slavery and theft at every opportunity, by any amount, for any people, under any circumstances, every single time I can.

|

|

|

|

|

Logged

Logged

|

Never ask a geek 'Why?',just nod your head and slowly back away...  IBA# 22107 VRCC# 7976 VRCCDS# 226 1998 Valkyrie Standard 2008 Gold Wing Taxation is theft. μολὼν λαβέ |

|

|

Willow

Administrator

Member

Posts: 16765

Excessive comfort breeds weakness. PttP

Olathe, KS

|

|

« Reply #21 on: December 05, 2017, 10:53:29 AM » |

|

And that's why they have you brainwashed.

...

But don't let facts get in the way of beliefs, who am I to pass judgment?

Anyone else see any irony here? Could someone confirm for me that "dinosnake" actually rides a Valkyrie?  |

|

|

|

|

Logged

Logged

|

|

|

|

|

Savago

|

|

« Reply #22 on: December 05, 2017, 10:57:21 AM » |

|

Why do all liberals hate this? If this passes it will put 15k more a year in my pocket. Everything I haved read claims to not help the rich so much but middle class and small businesses. I think all of you liberals only listen to your side. Liberals are just pissed because it was not their idea and assault rifle is not attached to it somehow.

I'm happy if that will help you out, brother (as you are not a big corp). :-) And I hope you are not calling me a liberal, cause I'm not. For SF Bay Area standards I'm considered a conservative really (e.g. support for the second amendment and others). My primary concern with this whole tax thing is that it will be *great* for Google and Apple, but pretty bad for people like me: engineer by my own merit with a family to provide. The other thing I got with it is that between 60-70% of the handover will go the big Corps and only the scraps will go to the people. It will also tax more the younger people, the generation that got the raw end of the deal in USA if you look in history. I can see next year executives bonus going sky high and the company parking lots in the SF Bay Area having new european/exotic cars everywhere. It will also spell problem for companies like Tesla, as they will cut some of the tax incentives for electric cars. I guess they can either jack up the prices or just move manufacturing a bit south (i.e. Mexico), which means less innovation and less blue collar jobs. It will also spell problem for the California State universities, remember lots of innovation in USA comes from here. Contrast that with China, where the government is actually increasing money dedicated to state universities. I only wished that the whole process of the Tax reform was made in a more studied and less radical way, with time for discussion and ensuring that it would help the people and not mostly the big corps and millionaires. The way I see it, they are taking money from upper middle class and giving it to the big corps (and a few scraps to low income people). And they are handing the tab for the younger people to pay for it. Finally, I hope neither you or friends/relatives depends on medicare or social security. I'm sure that when the mega deficit comes, they will cut into the people that needs the most. |

|

|

|

|

Logged

Logged

|

|

|

|

|

The emperor has no clothes

|

|

« Reply #23 on: December 05, 2017, 11:01:06 AM » |

|

Why do all liberals hate this? If this passes it will put 15k more a year in my pocket. Everything I haved read claims to not help the rich so much but middle class and small businesses. I think all of you liberals only listen to your side. Liberals are just pissed because it was not their idea and assault rifle is not attached to it somehow.

Mostly because, after listening to conservatives whine for decades about doing anything that raises the national debt... they vote for a tax plan that, not only grants the most benefits to corporations and those who can already afford to be in the [high] tax brackets where most of the reductions occur... it raises the national debt by 1.5 TRILLION DOLLARS. In other words, MORE HYPOCRISY. When it's a 'liberal' making a social package that happens to increase the debt, it's world-ending. When it's a conservative making a social package that happens to increase the debt...why are we complaining, exactly??? Not at all. The differences between the House version and Senate version are minimal. But at least Trump won't benefit from the proposals.    I hope that  was [/sarcasm], it's hard to tell. Because Trump will HIGHLY benefit from the tax cuts, his businesses are set up as "pass-through" (limited liability) corporations...which, conveniently, get some of the largest cuts in terms of operations. https://www.nytimes.com/2017/11/30/business/trump-benefit-tax-cuts.htmlhttps://www.washingtonpost.com/news/wonk/wp/2016/08/10/donald-trumps-new-tax-plan-could-have-a-big-winner-donald-trumps-companies/Did anybody actually consider WHO is paying for these "Tax breaks" ? The middle class of course.

We should have learned from Reagan - "Trickle Down Economics" do not work for anybody but the rich - who don't send them out to the rest of us....

That's the joke. 33% of the American public is constantly being gaslighted http://www.bbc.co.uk/news/stories-41915425Read it - it is NOT about politics, Trump, or anyone in government at all. It is about relationships. But does all that sound familiar? Charm your socks off...promises never kept. Things not working? It's your fault for not doubling-down and making it work out for me. Asking you for sacrifice...but always seems to end up one-sided. Yep. My friend, that was meant with all the sarcasm I can possibly muster.  |

|

|

|

|

Logged

Logged

|

|

|

|

|

The emperor has no clothes

|

|

« Reply #24 on: December 05, 2017, 11:11:35 AM » |

|

And that's why they have you brainwashed.

...

But don't let facts get in the way of beliefs, who am I to pass judgment?

Anyone else see any irony here? Could someone confirm for me that "dinosnake" actually rides a Valkyrie?  Any reason to doubt he does ? Other than you don't agree with his politics.  |

|

|

|

|

Logged

Logged

|

|

|

|

Willow

Administrator

Member

Posts: 16765

Excessive comfort breeds weakness. PttP

Olathe, KS

|

|

« Reply #25 on: December 05, 2017, 11:31:04 AM » |

|

And that's why they have you brainwashed.

...

But don't let facts get in the way of beliefs, who am I to pass judgment?

Anyone else see any irony here? Could someone confirm for me that "dinosnake" actually rides a Valkyrie?  Any reason to doubt he does ? Other than you don't agree with his politics.  Well, yes. Select his profile and show his posts. They're all political. Actually, way far down the page I did find a reference to a 2014. I can only guess it has very, very low miles.  Meathead, that was an insulting comment. I don't like your politics but you've not heard (read) me questioning whether your ride.  |

|

|

|

|

Logged

Logged

|

|

|

|

|

dinosnake

|

|

« Reply #26 on: December 05, 2017, 11:38:38 AM » |

|

I can see next year executives bonus going sky high...

Of COURSE it will. The conservatives have been snowballing their constituents into believing this will help the middle class. What Fox News didn't tell them, is that CEO's, during a meeting with the administration, TOLD THEM that they would NOT be using the tax benefits to add hiring or invest in new technologies http://www.chicagotribune.com/business/ct-biz-trump-tax-plan-corporate-investment-20171115-story.html if you don't like Chicago Tribune, many other media outlets covered the Council meeting event. Except Fox. The CEO's FLATLY stated that they would use the tax breaks to - a. Pay dividends to stockholders.

- b: Buyback stocks to increase their value

And guess what CEO's are mostly paid in? THAT'S RIGHT - stock options. Increasing buybacks of stocks increases stock values...which increases a CEO's pay! How convenient! |

|

|

|

« Last Edit: December 05, 2017, 12:32:08 PM by dinosnake »

|

Logged

Logged

|

|

|

|

|

dinosnake

|

|

« Reply #27 on: December 05, 2017, 11:40:19 AM » |

|

Well, yes. Select his profile and show his posts. They're all political. Actually, way far down the page I did find a reference to a 2014. I can only guess it has very, very low miles.  17,000 miles, and "only" that low because I was too busy this year buying a house. I barely got to ride this year!!   |

|

|

|

« Last Edit: December 05, 2017, 12:30:57 PM by dinosnake »

|

Logged

Logged

|

|

|

|

|

The emperor has no clothes

|

|

« Reply #28 on: December 05, 2017, 11:41:09 AM » |

|

And that's why they have you brainwashed.

...

But don't let facts get in the way of beliefs, who am I to pass judgment?

Anyone else see any irony here? Could someone confirm for me that "dinosnake" actually rides a Valkyrie?  Any reason to doubt he does ? Other than you don't agree with his politics.  Well, yes. Select his profile and show his posts. They're all political. Actually, way far down the page I did find a reference to a 2014. I can only guess it has very, very low miles.  Meathead, that was an insulting comment. I don't like your politics but you've not heard (read) me questioning whether your ride.  It wasn't meant to be insulting. It just seemed odd that you pick him out as a non riding infiltrator ? I don't go on the 1800 board much. But I'm pretty sure I've seen him post over there about his motorcycle. I can think of more than a few conservatives that post constant political stuff. No questions about their ownership ? |

|

|

|

|

Logged

Logged

|

|

|

|

Skinhead

Member

Posts: 8742

J. A. B. O. A.

Troy, MI

|

|

« Reply #29 on: December 05, 2017, 11:56:12 AM » |

|

Well, yes. Select his profile and show his posts. They're all political. Actually, way far down the page I did find a reference to a 2014. I can only guess it has very, very low miles.  Meathead, that was an insulting comment. I don't like your politics but you've not heard (read) me questioning whether your ride.  It wasn't meant to be insulting. It just seemed odd that you pick him out as a non riding infiltrator ? I don't go on the 1800 board much. But I'm pretty sure I've seen him post over there about his motorcycle. I can think of more than a few conservatives that post constant political stuff. No questions about their ownership ? Perhaps that is because he knows or has meet those folks at VRCC functions and events, or has in fact ridden with them. I don't mean to speak for Carl however. |

|

|

|

|

Logged

Logged

|

Troy, MI |

|

|

3fan4life

Member

Posts: 6997

Any day that you ride is a good day!

Moneta, VA

|

|

« Reply #30 on: December 05, 2017, 12:38:56 PM » |

|

Why do all liberals hate this? If this passes it will put 15k more a year in my pocket. Everything I haved read claims to not help the rich so much but middle class and small businesses. I think all of you liberals only listen to your side. Liberals are just pissed because it was not their idea and assault rifle is not attached to it somehow.

Mostly because, after listening to conservatives whine for decades about doing anything that raises the national debt... they vote for a tax plan that, not only grants the most benefits to corporations and those who can already afford to be in the [high] tax brackets where most of the reductions occur... it raises the national debt by 1.5 TRILLION DOLLARS. In other words, MORE HYPOCRISY. When it's a 'liberal' making a social package that happens to increase the debt, it's world-ending. When it's a conservative making a social package that happens to increase the debt...why are we complaining, exactly??? Not at all. The differences between the House version and Senate version are minimal. But at least Trump won't benefit from the proposals.    I hope that  was [/sarcasm], it's hard to tell. Because Trump will HIGHLY benefit from the tax cuts, his businesses are set up as "pass-through" (limited liability) corporations...which, conveniently, get some of the largest cuts in terms of operations. https://www.nytimes.com/2017/11/30/business/trump-benefit-tax-cuts.htmlhttps://www.washingtonpost.com/news/wonk/wp/2016/08/10/donald-trumps-new-tax-plan-could-have-a-big-winner-donald-trumps-companies/Did anybody actually consider WHO is paying for these "Tax breaks" ? The middle class of course.

We should have learned from Reagan - "Trickle Down Economics" do not work for anybody but the rich - who don't send them out to the rest of us....

That's the joke. 33% of the American public is constantly being gaslighted http://www.bbc.co.uk/news/stories-41915425Read it - it is NOT about politics, Trump, or anyone in government at all. It is about relationships. But does all that sound familiar? Charm your socks off...promises never kept. Things not working? It's your fault for not doubling-down and making it work out for me. Asking you for sacrifice...but always seems to end up one-sided. Yep. And that's why they have you brainwashed.

...

But don't let facts get in the way of beliefs, who am I to pass judgment?

Anyone else see any irony here? Could someone confirm for me that "dinosnake" actually rides a Valkyrie?   |

|

|

|

|

Logged

Logged

|

1 Corinthians 1:18  |

|

|

|

RDAbull

|

|

« Reply #31 on: December 05, 2017, 12:43:03 PM » |

|

Paying attention, Yes, and very closely.

As a professor of Taxation in one of the top 20 Undergraduate Accountancy programs in this country for the last 20 years it does create a great deal of concern for me. I do believe that most of you on both sides of the argument are missing the point on tax reformation. I know it is hard to believe but our elected officials are missing the point ever worse.

First point is that corporations do not pay taxes, period. They only act as conduits for the funds that we pay into them when we purchase their goods and services. The taxes they send to DC are just one of the costs of doing business they incur, just like Cost of Goods Sold or General Administrative and Selling expenses. If P&G doesn't collect that 1 cent extra to pay the Income Taxes on the sale of that bar of Ivory Soap they go out of business as an extreme example. The consumer pays all corporate taxes: income, property, sales, etc. Lower corporate taxes = higher personal taxes or higher deficits. The cash flow has to come from somewhere.

Point Two is that the idiots that we keep electing are in the money game, that is how they stay in power. If you think they are not going to help their big donors you are living in the wrong world. There is just too much back door money in the tax system to give them any inclination to fix it. If you want the problem fixed vote for somebody else. We already know that is not likely to happen.

Just like at home, you have to make choices on what we do, so must we hold the politicians to a standard that will allow our country to survive. My guess is we only have another 50 years to survive as a Republic, after that just another failed state if we don't act in a proactive manner.

Good Luck with that.

Point three is that the problem is not cash flow in but cash flow out. If we don't fix the debt it really won't matter in a few more years. We can't balance the budget let alone pay down any of the debt with our current mindset. China is getting to the point that they don't need to finance us anymore as they are getting their own economic system in place to buy the stuff they used to sell to us. If they don't need us to buy from them, they won't need to finance our debt. We have had a very bad symbiotic relationship with them for decades, they sell us their manufactured goods, therefore they export their employment problem and in exchange they finance our debt so we can buy their stuff.

This entire routine is an exercise in futility. They haven't addressed the problem of equity in taxation, yes the wealthy SHOULD pay more as their ability allows but we need to address the cost to our system of those whom only want to use that which others have built. There can not be meaningful tax reform without addressing the deficit, which obviously this does not.

Nothing they are doing is fixing the main problem that we have, misuse of the funds that we do provide them. This whole tax project thing is a sham and most will not recognize it until it is too late.

Milton Freidman is my Hero, but even he could not explain anything to politicians.

There have been thousands of books written on this, starting with:

Wealth of Nations, Adam Smith, 1776 - Read It.

Learn

Then Do!

|

|

|

|

|

Logged

Logged

|

2015 GoldWing Trike

1999 Valkyrie Interstate Trike, gone but not forgotten

|

|

|

|

G-Man

|

|

« Reply #32 on: December 05, 2017, 12:46:35 PM » |

|

As for the state deduction, why should the rest of the nation have to pick up slack for California's (or pick your other heavily socialized state) insane taxes?

I agree, and I live in Westchester County, New York. I live in THE highest taxed county in all of America. The average property/local tax bill here is over $15,000/year. My county, and the rest of southern NY, and CA, and IL, etc, voted time after time to give away more and better benefits which created the welfare states they have become. And now they're upset because they're gonna lose their deductions. They want to give away the store, but they want everyone else to pay for it. |

|

|

|

|

Logged

Logged

|

|

|

|

John Schmidt

Member

Posts: 15324

a/k/a Stuffy. '99 I/S Valk Roadsmith Trike

De Pere, WI (Green Bay)

|

|

« Reply #33 on: December 05, 2017, 12:47:14 PM » |

|

Oh brother is this getting exiting.....ZZZZZZZZZZZZZZZZZZ!!!!!!!!!!!!!!!!

|

|

|

|

|

Logged

Logged

|

|

|

|

3fan4life

Member

Posts: 6997

Any day that you ride is a good day!

Moneta, VA

|

|

« Reply #34 on: December 05, 2017, 12:54:44 PM » |

|

And that's why they have you brainwashed.

...

But don't let facts get in the way of beliefs, who am I to pass judgment?

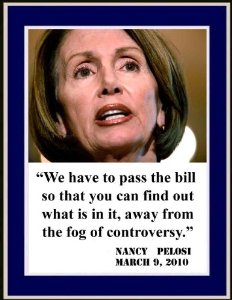

So let me see if I have this straight: You aren't willing to take a chance on the first real attempt on tax reform in almost 40 years..............  But you were PERFECTLY OK with this! |

|

|

|

|

Logged

Logged

|

1 Corinthians 1:18  |

|

|

|

G-Man

|

|

« Reply #35 on: December 05, 2017, 01:01:03 PM » |

|

How come the left doesn't seem to understand that businesses/corporations don't pay taxes? They collect them. The tax that a business pays to the gov't is collected from their customers as it is built right into the price of the goods and services the business provides. On top of that, the business also collects the tax on the sale. So the customer is paying a tax, on goods and services that are already laden with tax costs built into the pre sales taxed price.

|

|

|

|

|

Logged

Logged

|

|

|

|

|

G-Man

|

|

« Reply #36 on: December 05, 2017, 01:06:16 PM » |

|

I can see next year executives bonus going sky high...

Of COURSE it will. The conservatives have been snowballing their constituents into believing this will help the middle class. What Fox News didn't tell them, is that CEO's, during a meeting with the administration, TOLD THEM that they would NOT be using the tax benefits to add hiring or invest in new technologies http://www.chicagotribune.com/business/ct-biz-trump-tax-plan-corporate-investment-20171115-story.html if you don't like Chicago Tribune, many other media outlets covered the Council meeting event. Except Fox. The CEO's FLATLY stated that they would use the tax breaks to - a. Pay dividends to stockholders.

- b: Buyback stocks to increase their value

And guess what CEO's are mostly paid in? THAT'S RIGHT - stock options. Increasing buybacks of stocks increases stock values...which increases a CEO's pay! How convenient! CEO's pay increased more during the Obama years than ever before. Why didn't the Democrats do ANYTHING regarding this during the last 8 years? Why didn't they do anything in their platform at all over the last 8 years? One accomplishment that is failing terribly and based on lies. |

|

|

|

« Last Edit: December 05, 2017, 01:12:55 PM by G-Man »

|

Logged

Logged

|

|

|

|

|

|

Willow

Administrator

Member

Posts: 16765

Excessive comfort breeds weakness. PttP

Olathe, KS

|

|

« Reply #38 on: December 05, 2017, 01:25:48 PM » |

|

...

First point is that corporations do not pay taxes, period. They only act as conduits for the funds that we pay into them when we purchase their goods and services. ... The consumer pays all corporate taxes: income, property, sales, etc. Lower corporate taxes = higher personal taxes or higher deficits. The cash flow has to come from somewhere.

Thank you. That seems so simple and yet those enraged at "corporations are not taxed enough" refuse to understand it. |

|

|

|

|

Logged

Logged

|

|

|

|

|

G-Man

|

|

« Reply #39 on: December 05, 2017, 01:44:51 PM » |

|

They controlled both houses during Bush's administration and then the first 2 years of Obama's. Obama could have accomplished ANYTHING he wanted ............. Jobs, Racism, Inequality, Education, etc. Instead, he signed that trillion dollar stimulus bill that turned out to have 8,000 democratic earmarks and pork (after promising he'd never sign anything with that stuff attached) and the lies about shovel ready jobs. Then they chose force the failing ACA down our throats, based on lies and passed with senatorial bribes. America had enough and gave him a "shellacing" and took his power away, thank goodness. |

|

|

|

|

Logged

Logged

|

|

|

|

|